The Week That Matters (28 Oct-1 Nov, 2024)

"Politics is too serious a business to be left to politicians." Charles de Gaulle

This week the newsletter will argue the following points:

The US bond market is having a Deja-vu moment.

Trump will do a trade deal with China, if elected.

The European sovereign debt market should worry us more than it does.

The Bank of Japan means business.

Sam Altman is the new Nancy Pelosi.

Same as it ever was?

Scholars like to point out that the slow demise of the Roman Empire began when its Senate elected the two degenerates, Nero and Caligula. If you have been listening to some of the financial commentators recently, the US is at a similar point in its history. Apparently, the 47th President might be the start of something terminal. Whether that’s true or not, the author has no idea, but he would urge the reader to remember Rome wasn’t sacked for another three centuries after they came to power!

Technology might indeed speed up the process, but it takes a long time before an empire collapses. And perhaps, as we have seen with the City of London, the Roman Catholic Church and even the resurgence of Turkey as a political player on the world scene of late, empires don't always die. They evolve.

As usual, however, old titans of finance, who prefer the conference circuit to time with their (second) wives or grandkids, have loved talking in epochal terms. Some of the predictions have sounded almost biblical. The likes of Stanley Druckenmiller and Paul Tudor Jones have been more measured, to be fair, but both have talked of a day of reckoning for US bond markets.

The bears are also present in equity markets. Goldman’s put out a report saying equities wouldn’t return much this decade. It was one of those reports that lacked imagination, but it didn’t do anything for general sentiment.

There are two points to be made:

Old timers love moments like an election or a Davos conference to express their view (it’s almost always bearish!) on the world. Calling for chaos is their version of a Swan Song (aren’t you supposed to only have one of those?). The trouble is most of them have been calling for the end of the world since 2008. Isn’t that why most of them aren’t managing outside money anymore?

Extremely rich people, who are the clients of Goldman’s Wealth Management Division, have a private banker to hang around with, not for financial advice. They have made their money already (most inherited it, to be fair). They have stopped thinking about opportunity cost. Goldman’s knows that. Calling the top here will be perceived as Goldman’s being prudent by their clients, even if the call is wrong. The report was a “nothing burger.”

The Founding Fathers feared the experiment that was the USA wouldn’t endure. For the author, it’s that paranoia that has helped the nation survive and prosper. Some fear about the direction of the country should therefore be welcomed. The trick when investing is to avoid getting carried away with emotion and to try to see things for what they are. The author doesn’t think it’s as bad yet as many people think in the USA. He is still hopeful for a year-end rally.

US Bond Market: Reality Check

It’s easy to get bearish on the state of the USA. It’s not just the divided population, the oligarchic political system or the wealth divide. It’s how the nation interacts with the international community.

The rest of the world just can’t understand why the USA pursues the foreign policy it does, which isn’t boosting confidence either. For many, it seems unproductive, almost destructive. But hasn't it always been like that? There is nothing new there. It just feels more immediate as social media has democratized access to news.

In some ways, the average citizen was innocent even as late as 2003. We didn’t want to really understand what was going on. The book, Confessions of an Economic Hit Man, told us everything we needed to know in 2004 but most of us just chose to ignore it. Some even continued to believe in wars that spread democracy back then.

But the neo-con philosophies that took hold after the Soviet Union collapsed do not represent the whole US story. If you ignore them for a moment, the USA remains the winner of most commercial battles, and its wealth continues to be unfathomable. Consider its land, its infrastructure (it’s crumbling but it’s still considerable), its IP, its people, its universities. It’s something we often forget.

The big focus for the bears right now is the public financial picture of the USA. That makes sense. The recent large moves in US Treasuries imply a serious problem. But as always with bond market moves, the author would suggest it makes sense to be circumspect. There are four things to consider:

There is a myriad of reasons why treasuries move. The moves are often unrelated to conventional macro models. People love to attach explanations to moves to soothe their confirmation bias. It’s almost always a mistake. How much money has been made betting against the US or the Japanese bond market for the last 30 years?

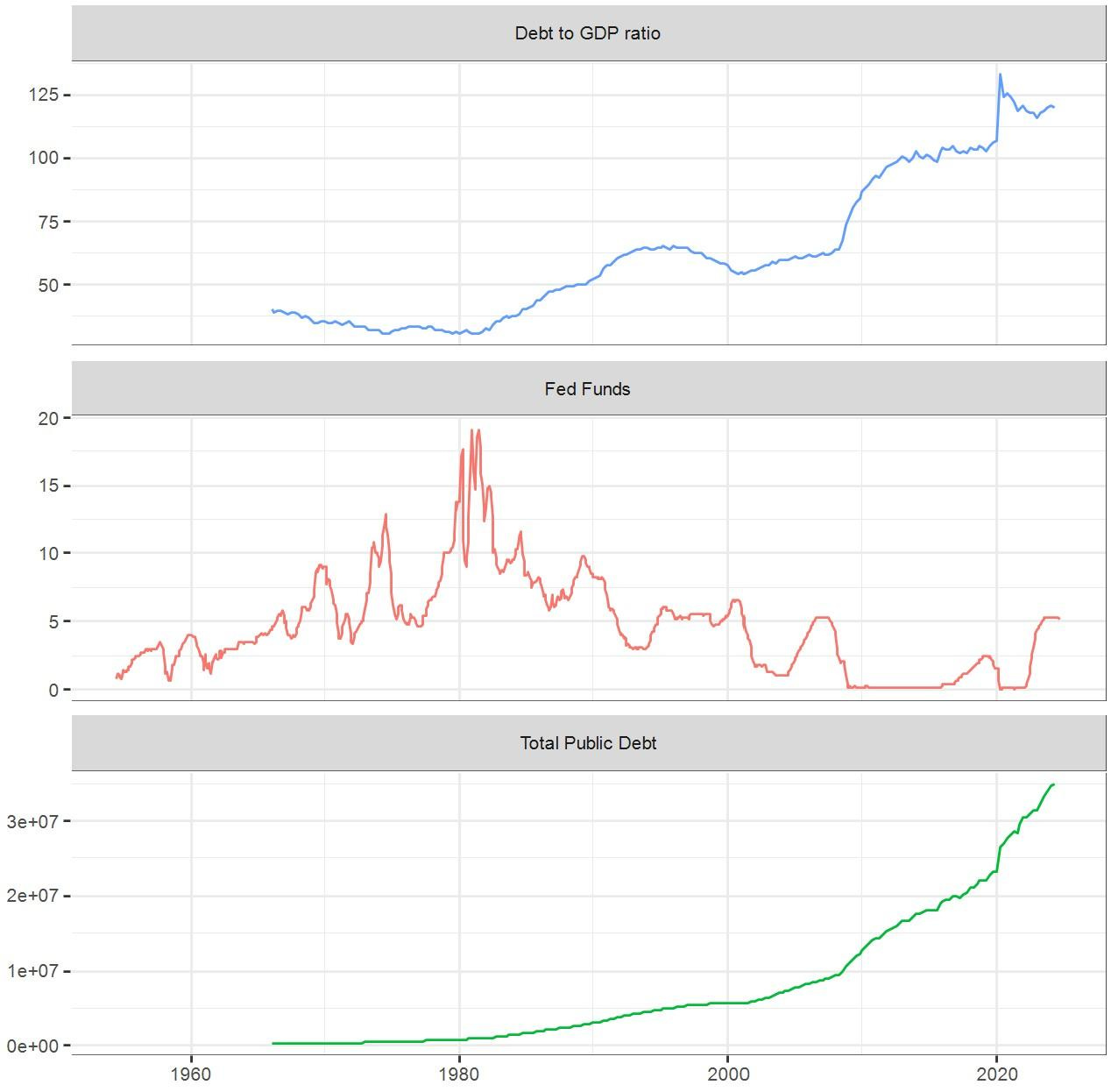

There is no correlation between levels of debt and interest rates, neither between years in the same country nor in the same year between countries, and not in companies. Data simply does not show such a relationship. Take a look at this chart:

The public debt is manageable. In 2000, the U.S. interest payments on public debt was circa USD$232 billion. In 2023, interest payments were USD$655 billion. That’s 2.82x growth. In the same period, the US GDP has grown 2.6x from USD$10.6 trillion to USD$27.4 trillion. The total public debt is USD$34.8 trillion, which is bigger than the annual GDP. That’s not great but it’s not a disaster, right?

The exact same thing happened in 2016. There was a concern that Donald Trump then would spend money like a drunken sailor. As soon as the election took place, things began to normalize. Won’t that happen again? If Kamala gets in, the normalization will be quite quick, one would imagine.

Will Trump do a deal with China?

Recently, the author argued that tariffs were as American as Apple Pie. The author stands by that statement. The US has always been prone to protectionism. It’s what made it successful during the 19th Century. The US might not have been the success it became if it had traded on an equal footing with the British Empire.

Such an observation prompts an interesting question. What role does protectionism play in a country’s development? Globalization may have meant China could get at least half of its population out of poverty, but it would not have been possible if China hadn’t controlled the process. It saw what havoc a lack of capital controls could mean for a nation during the Asian Financial Crisis of 1997. It’s one of the reasons it didn’t want Jack Ma, with foreign backers, anywhere near China’s consumer finance industry.

If Trump does make it into the White House, he has promised he will be tough on China. But didn’t he say that in 2016? The reality was rather watered down back then. The author thinks the same will happen again. Donald Trump is a master at negotiation. But the author feels he will do a deal with China, that will please the equity market for three reasons:

Keep reading with a 7-day free trial

Subscribe to Mateen's Newsletter - Discuss The Tape to keep reading this post and get 7 days of free access to the full post archives.