The Week That Matters (25-29 Nov, 2022)

"There is always light behind the clouds" Japanese proverb

Podcast #2

The author apologizes for the tardiness of this newsletter. He was caught up with a personal matter over the weekend. Nonetheless, he was able to interview Jamie Halse, the Founder of Senjin Capital, on Friday morning! Please have a listen:

Jamie is an experienced Japanese equity fund manager, who cut his teeth at Platinum Asset Management. He is now launching his own fund, Senjin Capital, which aims to engage closely with Japanese management teams to unlock value for all stakeholders. If you’d like to speak with Jamie, please let the author know or reach out to him directly on linkedin. He knows his stuff!

As always, any feedback on the podcast would be greatly appreciated. And if you don’t mind, please like and subscribe. We have a great pipeline of guests, who are all experts in their field. And yes, the thumbnail is AI generated!

Institutional Memory: A trading strategy

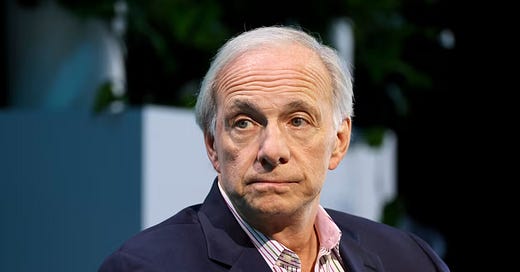

This newsletter has argued before that a mandatory retirement age for fund managers might make sense. Some of the old timers have got it horribly wrong over the last 10-15 years. They love making big calls on the conference circuit (Ray Dalio!), but when you back test their ideas, their predictions often lack merit.

Unfortunately, asset allocators and many wealth managers often act like bean counters. You don’t get fired allocating to brand names like Bridgewater or even GMO, even if the alpha is non-existent. And so the old timers tend to get bigger, not smaller, despite mediocre performance. That means young fund managers often don’t stand a chance. Their only option is be hoovered up by platforms like Millenium!

Of course, this also means we don’t get the return on capital the world needs. We have been sold a narrative that 12% is good enough. It isn’t, especially for the large pots of capital! They should take much more risk. Why doesn’t Norges own more of Space X, for example? Why on earth would the sovereign fund bother with private credit? Isn’t it time there was a re-think?

The ageing fund management industry has one advantage for the aspiring individual trader, however. It often becomes predictable which stocks will become popular over a cycle as it’s the same people pushing the buy button. The author has observed this on countless occasions when emerging markets have a rally. He even used to see it happen in a developed market like Japan in the old days. Fund managers, like most people, tend to go back to what they know. The trick is to pick stocks before institutional memory kicks in.

Trump getting elected for a second time allows us to test the theory. The results are interesting. What moved in 2016 is moving again in 2024. NVDA, for example, is up more or less the same amount YTD. And John Deere defied the bears in exactly the same way last week as it did in 2016, when it reported poor forecasts! History rhymes even in capital markets, it would seem.

History rhyming is part of the reason the author remains bullish into the year end. Dan Niles noted today that over the last 75 years, the S&P has been up over 20% YTD on 16 occasions by November. In those cases, December tends to be a strong month: circa +1.9%.

Looking ahead, the author is wondering whether 2025 might end up being like 2017. China ended up recovering nicely that year (Trump was serious about tariffs too back then) and resources and commodity stocks got a rerating. The author hopes to get a fund manager on the podcast, who will describe the opportunity in the smaller resource space in Australia. Globally, they look conspicuously weak. The stocks are on their knees. Could they get a rerating in 2025? The author can’t see a reason why not!

Making Japanese Engineering Great Again

Last week Japan’s main financial newspaper noted Mitsubishi Electric will launch its 6th Michibiki satellite. It aims to develop Japan’s version of GPS. The news might only sound marginally interesting but for the author, it’s more evidence to suggest Japan is getting even more serious about space technology. Earlier this month, Japan launched LignoSat on a SpaceX mission. LignoSat, developed by Kyoto University and the author’s favorite homebuilder, Sumitomo Forestry, is the first wooden satellite that’s gone into space.

Japan is no minnow when it comes to space. Japan’s space technology industry has a long history, going all the way back to the 1950s. What stood out with its approach is Japan never focused on building something that would put a flag on a new planet or on the moon like the USA and the Soviet Union did in the 1960s. Instead, it focused its attention on technology that could extract minerals from asteroids using its robot technologies.

Japanese Engineering Comeback

The author last week argued we will see a renaissance of complex engineering. Musk has proven that incredible things are possible again. He has shown the world that there are bigger problems to put our greatest minds to than organizing your receipts or making it easier for poor people to spend money. He should be celebrated for that.

This is in stark contrast to the 2010s, which the author describes as a lost decade for technological advancement. Think about it. What did all those dollars in venture capital really achieve? Buy now, pay later technology did nothing for mankind and most vertical SaaS plays didn’t hugely improve productivity, did it?

What’s exciting is it’s not just a US thing. Just as AI was never just a Silicon Valley thing, the developments in complex engineering are a global thing. Incredible things are happening in China with respect to scaling manufacturing and specific areas like batteries. The author thinks it’s just a matter of time before China catches up with ASML - he knows that’s punchy, but China has achieved great things recently. You don’t want to short Elon Musk, the engineer, but you don’t want to be too underweight Chinese engineering either.

Perhaps, what’s most encouraging is the major break throughs happening in Japan. There seems to be a new confidence in research tanks and universities. And they haven’t had the research quality scandals that have taken place in the West. We touch upon it briefly in the podcast, but Shinzo Abe was an incredible man. He may have given Japanese academics a renewed lease on life too. And no-where is that more obvious than in space technology.

The author believes Japan is on the cusp of a space technology boom. The Japanese government has set a goal of increasing the size of the Japanese space industry from Y4 trillion in 2020 to Y 8 trillion by 2030.

The question is how do you play it? The author has identified 16 stocks to have on your radar screen:

186A Astroscale

Founded in 2013, the company operates in Japan, the US, the UK, France, and Israel. It has been commissioned by JAXA and space agencies of major countries to conduct debris removal demonstrations. In recent years, the company has been developing technologies to capture debris with satellites and remove it by dropping it into the atmosphere, as well as technologies for refueling satellites.

Keep reading with a 7-day free trial

Subscribe to Mateen's Newsletter - Discuss The Tape to keep reading this post and get 7 days of free access to the full post archives.