The Week That Matters (23-27 Sep 2024)

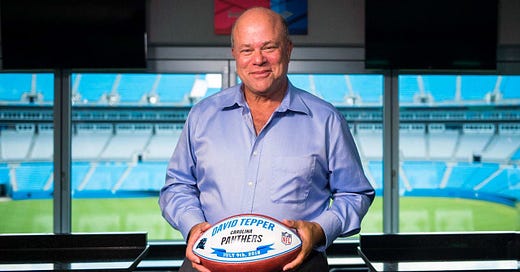

“I’m just a regular upper-middle-class guy who happens to be a billionaire.” David Tepper

Introduction

The newsletter will argue the following points this week:

The Chinese stimulus measures that have just been announced might end up being as important as the TARP program was in October 2008 for global markets.

China has set a floor for its equity market, but financial engineering will only get it so far. An ambitious fiscal plan is needed to turn China’s real economy around.

The Yen Carry Trade continues to be the big global tail risk! October could be a tricky month.

Play for the recovery?

Michael Burry wouldn’t even have been in a movie if John Paulson had said yes. He was in no way the biggest actor in the sub-prime trade. People also forget he committed the original sin in fund management - he gated investors. We pay too much attention to quirky mavericks who get it right once a decade. Not enough time is given to fund managers who churn out good returns year in year out.

David Tepper is an example of a fund manager to whom people don’t pay much attention. He may not have had a movie made about his life, but he has made a lot more money for his clients than Michael Burry has. He lost money in 2008 like most people, but he crushed the recovery from 2009 like George Soros did. Playing for the recovery is how you make the real bucks, right?

His comments this week on TV deserve attention. He is not your average portfolio manager. He knows when to ramp it up and ignore benchmarks. He was very bullish in 2010 when Howard Marks and Stanley Druckenmiller forecasted a poor decade for equity returns (doesn’t Marks do that every decade?). And he is very bullish now. Indeed, what has transpired over the last few weeks might prove to be very significant for equities.

The Fed has started cutting rates. Powell is behind the curve. He will start getting desperate soon.

The Bank of Japan has been appeased for the time being. Mr. Ueda said he’s unlikely to hike again soon. (More on this later)

China announced a series of stimulus measures that were as substantial as this newsletter suggested they would be on September 1 (Victory lap!).

Soros said, “the worse a situation becomes, the less it takes to turn it around, and the bigger the upside.” The author is starting to think the Chinese measures this week could underwrite the recovery in 2025/2026. It’s not a fait accompli as China has a long way to go but there are signs that the big ship of China might be pointing in the right direction again. Let’s go!

China’s version of TARP?

Boomers remember where they were when President Kennedy died. Middle aged investment bankers (former and current) remember the day TARP was announced. It was an unprecedented government measure to shore up the economy just after Lehman’s. Few in banking at the time imagined that it was even possible.

Keep reading with a 7-day free trial

Subscribe to Mateen's Newsletter - Discuss The Tape to keep reading this post and get 7 days of free access to the full post archives.