Nippon Banzai!

As the author believes this could be a pivotal year for Japanese stocks, this letter from Discuss the Tape (out every Friday) will be focused on the internal mechanics of the Japanese equity market. It is an attempt to explain what the author is doing there to make money. You must, of course, do your own research. It is NOT financial advice.

It will be divided into three sections. The first section will focus on one or two key stories from the week. The second section will look at price action of specific stocks or sectors. The third section will include a stock recommendation.

Part 1: Wages and Nippon Steel

Wages Matter

The highlight for the week was the solid wage data that came out. Salaries grew the most in 32 years. Nominal wages grew by 3% versus an expectation of 2.7%. It’s not all rosy, of course. The bears will point to real cash earnings dropping 0.3% from a year earlier, partly driven by inflation outpacing pay growth. But they will be getting it wrong as usual.

Equity investors must ignore the noise and extrapolate the major trends to garner the most profits. And the trend for the author is obvious. The virtuous cycle is well under way. Higher inflation will lead to higher wages, which will in turn lead to higher consumption. Importantly, we have the annual wage hike in April to look forward to. Last year wages were increased by 5%. This year the expectation is for a respectable 3% increase!

Why is this important? It’s simple. Wages matter! Unlike the Milton Friedman obsessed oligarchs who run the US, the Japanese administration has never forgotten this. They have always known that inflation, without a consistent increase in wages, is just not possible. There was just no way to get wages higher without a major change! It required top-down driven policy to make it happen. We are now reaping the rewards of what Shinzo Abe instigated all those years ago.

It’s not just wages, of course. Higher share prices and higher house prices matter too. We saw that in 2020 during COVID. We forget how we sat on the edge of a deflationary abyss. If Steve Mnuchin hadn’t been as capable as he was, things could have got very dark indeed.

House prices have already moved a lot in Japan but it’s the equity market that is much more interesting. It is the author’s contention that it has a lot more upside and part of the reason for that is Japan’s NISA program, Japan’s tax-efficient investment scheme (more on that in Part 2).

NIPPON STEEL

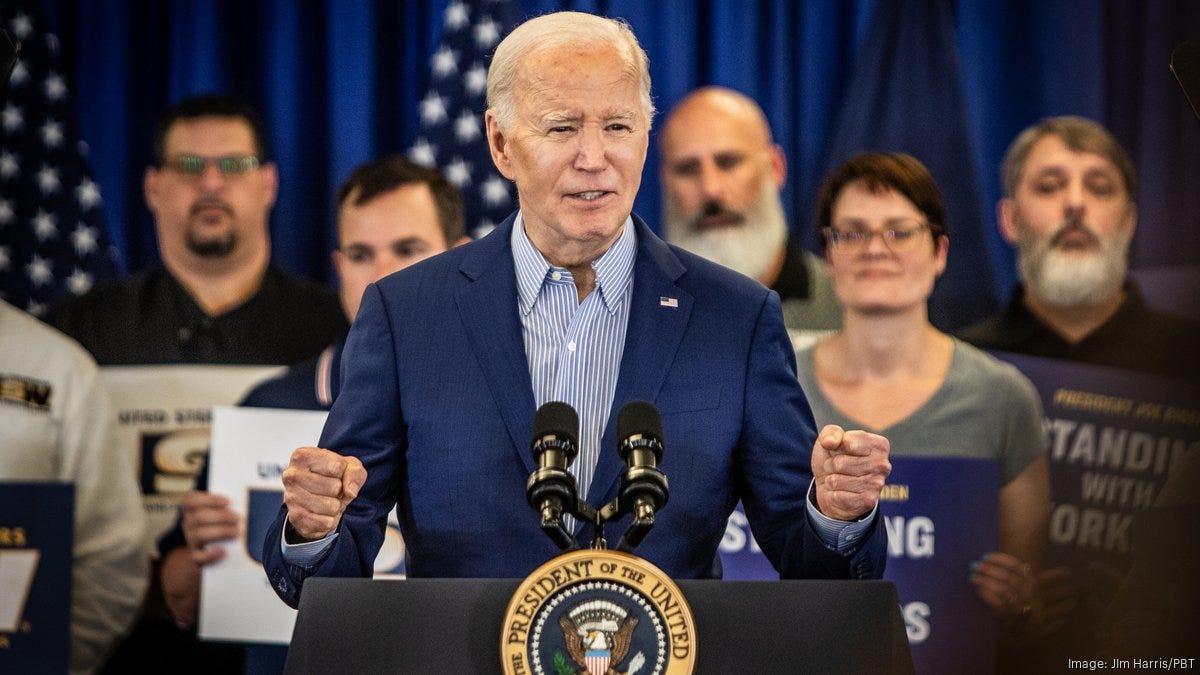

The atmosphere in the Nippon Steel press conference to the Japanese press was icy cold. President Biden’s decision was met with disappointment and frustration by the management of the company. For the acquisition to still succeed, Nippon Steel must win in court and gain the approval of Donald Trump.

There are three points to make:

Nippon Steel’s overseas expansion might have to overcome similar obstacles elsewhere. The US is not alone in considering its steel industry as a national strategic asset. The reason Japanese steel companies have been successful with M&A in Southeast Asia is because Japan has more political influence there.

It might have been a very lucky escape. US Steel is in poor shape. It is heavily unionized and needs massive investment. Most big M&A deals are value destructive and occur at tops in the market. US market valuations are high as is the US Dollar.

The street will no doubt take down numbers but even if the acquisition doesn’t take place, you still have a company with an annual divided of Y160 (over 5% yield) which can be sustained. Does it now focus on some of its listed subsidiaries?

Part 2: Niche Tech, Domestic stocks and Content

Niche tech companies with high market share

This newsletter has been arguing that buying oversold semiconductor related plays that dominate their niche might be an effective investment strategy this year. Thankfully, Japan is full of them.

This week, Jensen Huang, the CEO of Nvidia, in yet another impressive leather jacket, argued two things at the CES conference in Las Vegas:

The semiconductor cycle would go from strength to strength.

High Bandwidth Memory would be a very big deal.

His comments supported the author’s thesis. Not only did Micron in the US catch a bid, but the HBM related names in Japan also started to move: 8035 Electron, 6857 Advantest, 6146 Disco, 6315 Towa and 6871 Japan Micronics.

The author is playing the move through Towa and Japan Micronics. Foreign investors might buy the more liquid names like 6146 Disco (see chart) but the author is more interested in what the Japanese retail investor will buy. It is his opinion that retail will prefer some of the smaller names.

Domestic Issues with Yield

Donald Trump is a risk. Exporters in Japan suffered in 2018 when Trump got serious about tariffs. It is anyone’s guess what will happen but for now, perhaps it’s worth being overweight domestic names that should benefit from the steady growth in nominal GDP that seems plausible this year. Think banks. Think insurance. Think a sector like construction.

Keep reading with a 7-day free trial

Subscribe to Mateen's Newsletter - Discuss The Tape to keep reading this post and get 7 days of free access to the full post archives.