DISCLAIMER: None of this is financial advice. The opinions expressed are purely my own opinions and it is imperative for you to do your own research. They do not represent the views of any company I am associated with.

JREITs

In January, a Singapore fund, 3D Investment Partners, announced a tender offer for 8956 NTT UD REIT. The author thought it would be a turning point for the sector. It highlighted how cheap the space had become. It was also the first time a Japanese REIT had been a target of an activist (he thinks!).

But the market didn’t care much. There were other things to focus on. President Trump had just had his inauguration, and long-term yields were on the rise in Japan, reaching a recent peak of 1.587 % on the 27th of March.

But that was then. And the world has changed a fair bit since January. Despite President Trump scaling back on his tariff strategy at the behest of Big Tech over the weekend, he has crossed the proverbial Rubicon.

Not only has it changed attitudes towards owning US Treasuries, but it has also increased the likelihood of a recession, even a liquidity crisis as Paul Krugman suggested. It is true the market can always climb a wall of fear, but the author is less optimistic than usual this time. He imagines the equity market to be at least range bound until a new target day (Liberation Day 2.0) in July. Instead of US tech, he is happier to stay long GOLD miners and of course, the YEN.

This has brought him back to JREITs. Yes, Japanese long-term yields might go higher, but he thinks there is value in the space and if you take a long-term view, current prices might prove to be good buying, if not a steal. At the end of the day, you get Yen exposure and a healthy yield. What’s wrong with that? Let’s dig deeper.

They’re cheap

With the exception of Nippon Building Fund, the JREITs are all trading below NAV.

The Yen’s trajectory is becoming clear.

There were concerns that the Japanese Yen might weaken in January. The opposite is true now. If we are living in a 2008 world, the Yen might again be a currency of safety. Could it go to Y120 to the US Dollar? The author is no currency expert, but he has seen big moves in the Yen before. He thinks we might see one again. Why is no one spending more time on the Yen Carry trade btw?

Japanese retail is repatriating money

Japanese retail investors CRUSHED the moves over the last few years in US technology stocks. Japanese housewives can be formidable traders but even they will be a bit nervous with what’s going on in the US. If they bring money home, it will find its way into Japanese REITs. They are cheap and many names yield over 5%.

Foreign investors are starting to buy

The author has made money in the past paying attention to what foreign investors are doing with JREITs. They periodically “discover” them like they discover Nintendo. And they now seem to have turned into a net buyer, after being a net seller all last year.

Office Rents are going up

Rising rates tend to hurt REITs, but the increased costs can be offset by rising rents. And that’s what we’re seeing in Japan. Rents have risen for 13 consecutive months since February 2024, reaching JPY20,481 in February 2025, but they remain more than 10% below the previous peak, indicating significant room for growth.

Residential Rents are going up

It’s not just offices that are experiencing rental hikes. Residential REITs are renewing leases at much better rates. 3282 Comforia Residential REIT, with properties in the 23 wards of Tokyo accounting for about 90% of its portfolio, increased rent by +9.3% upon tenant turnover and +1.4% upon lease renewal. It’s not the only one to experience this.

Inbound Tourism = higher hotel rates

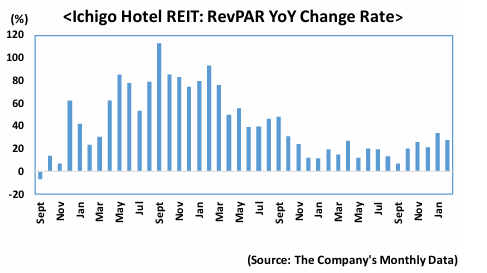

As Japan becomes the new Bali for Australians and all the other tourists, it’s no surprise that hotel accommodation fees have also continued to rise. The best example of that is the YoY change in revenue per available room numbers that 3463 JP Ichigo Hotel REIT disclose. They have been positive for 40 consecutive months from October 2021 to February 2025.

Below is a list of REITs in Japan that are worth looking at. The author has split them up into the following categories: Office, Residential, Complex (complicated business models), Diversified, Commercial, Hotel, Logistics and Healthcare. Yes, it’s quite diverse. Japan has 7% of the global REIT market by capitalization, which puts it in second place just above Australia.

Office

3234 Mori Hills Reit Investment Corp

Thie REIT owns most of the big buildings in Roppongi. It owns ten buildings which includes offices, residences, and commercial facilities such as "Roppongi Hills Mori Tower" and one plot of land (acquisition amount: Y401.6bn). For 1/25 fiscal period, the dividend per unit decreased by JPY230 to JPY3,080 compared to the fiscal period 1/24. The expected dividend per unit for FP7/25 is JPY3,090, and for FP1/26 is JPY3,100. The annual expected dividend per unit yield calculated at the market price is about 4.69%. Price/NAV ratio is roughly 0.82x.

Keep reading with a 7-day free trial

Subscribe to Mateen's Newsletter - Discuss The Tape to keep reading this post and get 7 days of free access to the full post archives.