Japanese Mobile Gaming: Oversold?

"Reality is broken. Game designers can fix it." Jane McGonigal

A defensive play in a turbulent world?

Mobile gaming in Japan and in the West is a mature industry. But it’s still thriving in China and Southeast Asia. After rapid growth due to the pandemic, the industry contracted in 2022 and 2023, but the trend has now shifted back towards growth due to its popularity in Asia.

According to the research firm, Newzoo, the global mobile gaming market size increased by 3.0% YoY to $92.6 billion in 2024. This was a reversal of a decline of 2.1% YoY from the previous year.

Changes in Distribution

For a growth minded investor like the author, 3% is a bit of a yawn but we are living through interesting times. There are of course many cheaper names in Japan to take a close look at during this sell-off, but the author wonders whether mobile gaming companies might see the biggest share price recovery, if there’s a turn. They are, of course, less exposed to the US tariffs than other areas of the market but there is also one other reason: their industry might be one way to fight back!

The Japanese, like the Europeans, might now start to get more demanding of US Big Tech. The Europeans, but also the Japanese to a similar extent, have been too lenient with them. And one way to make it harder for firms like Google and Apple is to enforce rules regarding how mobile games are distributed. Let the author explain.

App Store Duopoly

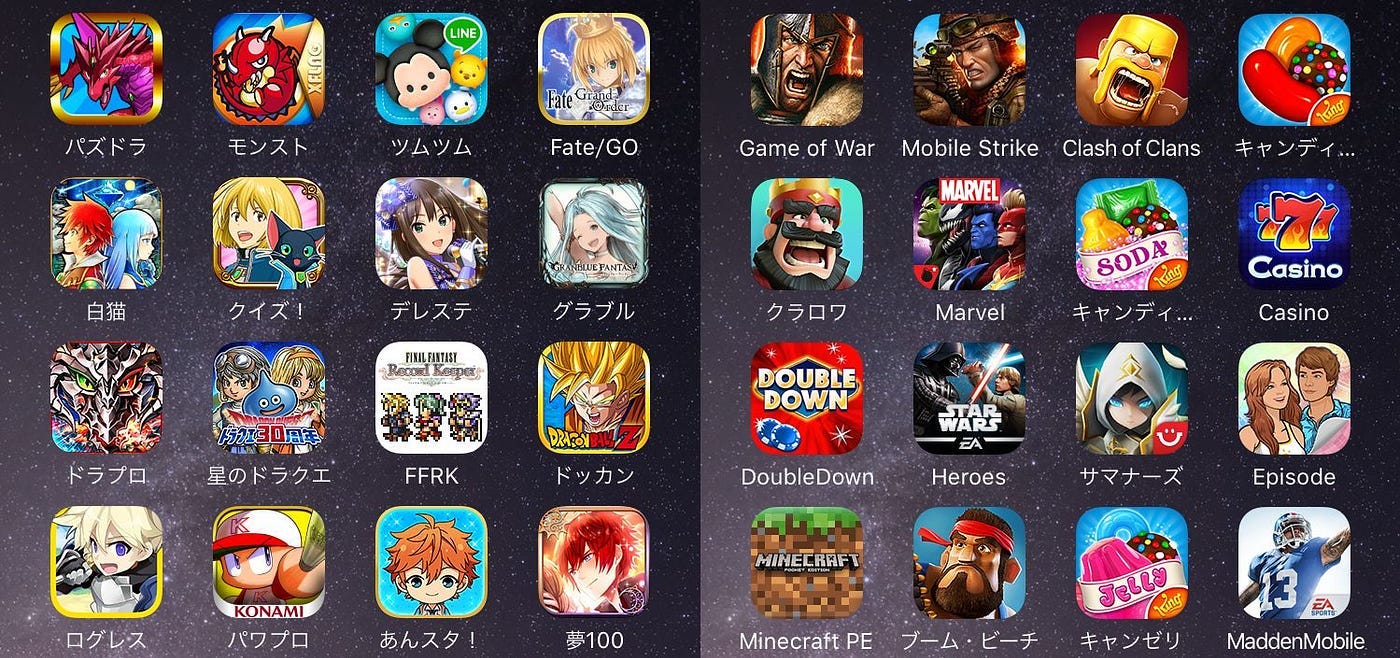

App stores act as intermediaries between game developers and users. Approximately 30% of all revenue generated through game sales and in-app purchases is paid to the app stores.

App stores are almost exclusively controlled by US companies like Apple and Google as they provide the operating systems needed to run smart phones. Combined they have market shares of over 90% globally.

Apple does not allow the use of third-party app stores on devices equipped with iOS outside of Europe, and even within Europe, such stores must subject themselves to the company's review. Apple also charges fees based on the number of users.

While Google allows external stores for devices equipped with Android, it monopolizes the payment section, making it challenging for operators of external stores to secure revenue. This seriously limits the opportunity for new entrants. In turn, 80% of users use the app store provided by Google.

New Laws = Tectonic Shift

Something big has been happening in the background for a while now. In August 2020, Epic Games sued Apple and Google, claiming their app distribution and billing systems were monopolistic. The world started to take note.

Following the lawsuit, Apple allowed app developers to use third-party payment methods. This was an acknowledgement that developers had a point. This only fueled the debate.

In November 2022, Europe enacted the Digital Markets Act (DMA). The law was fully implemented in March 2024. It obliged platform providers to ensure interoperability with competing apps and to open up data access.

Japan followed suit. The Smartphone Software Competition Promotion Act was enacted in June 2024, with full implementation planned by December 29, 2025. If Europe is a good indicator of what might happen, the adoption of external stores might be a slow burn. But the author would suggest the use of third-party payment systems will gradually increase now. In fact, in June 2024, Digital Garage, a payment processing business, took the lead in launching Japan's first third-party payment service, "AppPay."

If an app development company creates its own third-party payment system, or uses a third-party payment service, it could reduce its fees from 30% to as low as 5%. According to Digital Garage, if an app company switches 30% of its billing revenue to a third-party payment service, it is estimated that the app company's billing revenue could increase by 10%.

The author has listed stocks below that could benefit from the proliferation of third-party payment systems with a quick summary of the company’s recent financial performance:

Third Party Payment Services

4819 Digital Garage

Keep reading with a 7-day free trial

Subscribe to Mateen's Newsletter - Discuss The Tape to keep reading this post and get 7 days of free access to the full post archives.